nassau county tax rate calculator

Sales Tax in Nassau County Florida is calculated using the following formula. Sales Tax Rate s c l sr Where.

Connecticut Property Tax Calculator 2022 Suburbs 101

Delaware DE Transfer Tax.

. Calculate Your Personal Nassau County Property Tax Rate. While SmartAsset places Nassau Countys average tax. 179 of home value Yearly median tax in Nassau County The median property tax in Nassau County New.

This is the total of state and county sales tax rates. 2021 Nassau County Municipal Tax Rates. Even so the average effective property tax rate in Suffolk County is 237 far above both state and national averages.

This rate includes any state county city and local sales taxes. The current total local sales tax rate in Nassau County NY is 8625. 2019 Median Tax Bill Data.

The State of Delaware transfer tax rate is 250. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County. 2 days agoNassau County voters approved a 1 mill increase in property taxes to raise money to attract and retain high-quality teachers and staff and enhance art athletics safety and security.

Tax Collector Office Locations Locations in Yulee Callahan Hilliard and Fernandina Beach. Sales Tax Rate s c l sr Where. Sales Tax in Nassau County New York is calculated using the following formula.

S New York State Sales Tax Rate 4 c County Sales Tax Rate l Local. For comparison the median home value in Nassau County is. The December 2020 total local sales tax rate was also 8625.

Assessment Challenge Forms Instructions. How to Challenge Your Assessment. STIPULATION OF SETTLEMENT CALCULATOR.

Nassau County New York Property Tax Go To Different County 871100 Avg. The current total local. The minimum combined 2022 sales tax rate for Nassau County New York is.

This includes the rates on the state county city and special. NASSAU COUNTY ASSESSMENT REVIEW COMMISSION. 74 rows Nassau County New York Sales Tax Rate 2022 Up to 8875 Nassau County Has No.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. 2020 rates included for use while preparing your income tax deduction. In dollar terms Westchester.

The average cumulative sales tax rate in Nassau County New York is 865 with a range that spans from 863 to 888. Choose a tax districtcity from the drop-down box. In zip code Leave the zip code default for purchases made in.

The New York state sales tax rate is currently. Nassau NY Sales Tax Rate. 4625 Nassau County Sales Tax Calculator Purchase Details.

Texas has a 625 sales tax and Harris County collects an additional NA so the minimum sales tax rate in Harris. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. S Florida State Sales Tax Rate 6 c County Sales Tax Rate l Local.

Nassau county tax rate calculator Sunday March 6 2022 Edit.

News Flash Nassau County Ny Civicengage

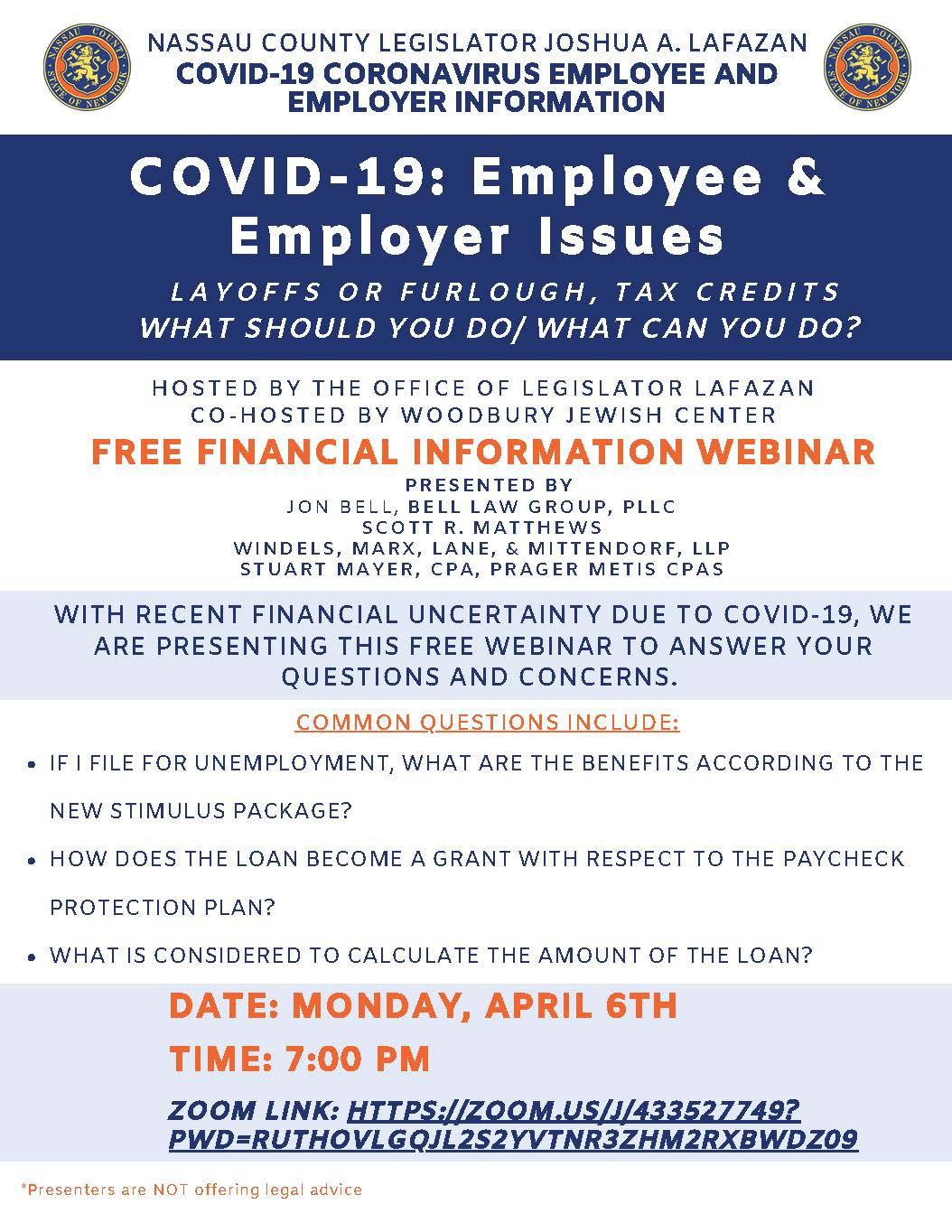

Windels Marx Covid 19 Scott Matthews Joins Nassau County Legislator Josh Lafazan On April 6th

Nassau County Tax Map Verification Fee Increase The Judicial Title Insurance Agency Llc

Car Loan Calculator Florida Dealer Consumer Calculator

Nassau County Ny Property Tax Search And Records Propertyshark

Tax Grievance Appeal Nassau County Apply Today

Frequently Asked Questions Town Of Oyster Bay

Nassau County Property Tax Reduction Tax Grievance Long Island

Florida Sales Tax Calculator Reverse Sales Dremployee

County Nassau Transfer Tax Fill Out Sign Online Dochub

Property Tax Calculator Tax Rates Org

Sticker Shock Long Island Business News

Florida Sales Tax Rates By City County 2022

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

4 Options When Facing Back Property Taxes Nassau Suffolk County Ny

Sales Tax Definition How It Works How To Calculate It Bankrate

Compare Your Property Taxes Empire Center For Public Policy

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation